Mobile Gaming Outlook & Forecast:

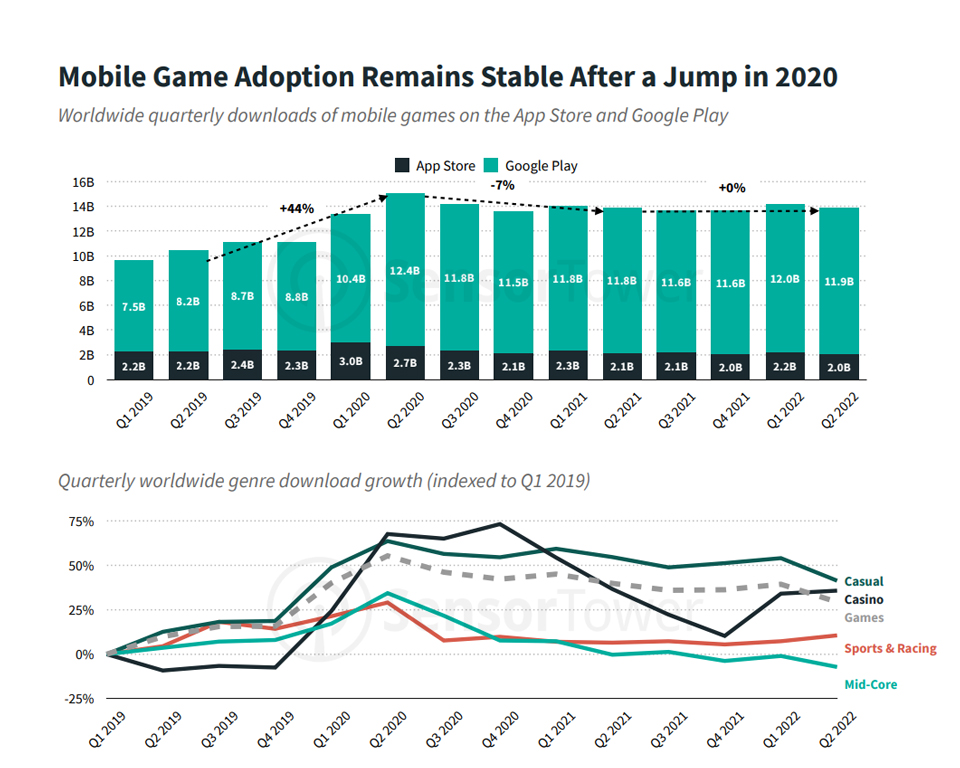

The mobile game market remains stable after experiencing big gains starting in Q1 2020 at the beginning of the pandemic. The global downloads are currently at about the 14 billion mark.

More than half of player spending is in the Mid-Core class; however, the vast majority of downloads are from casual games which account for 80% of downloads, including hypercasual.

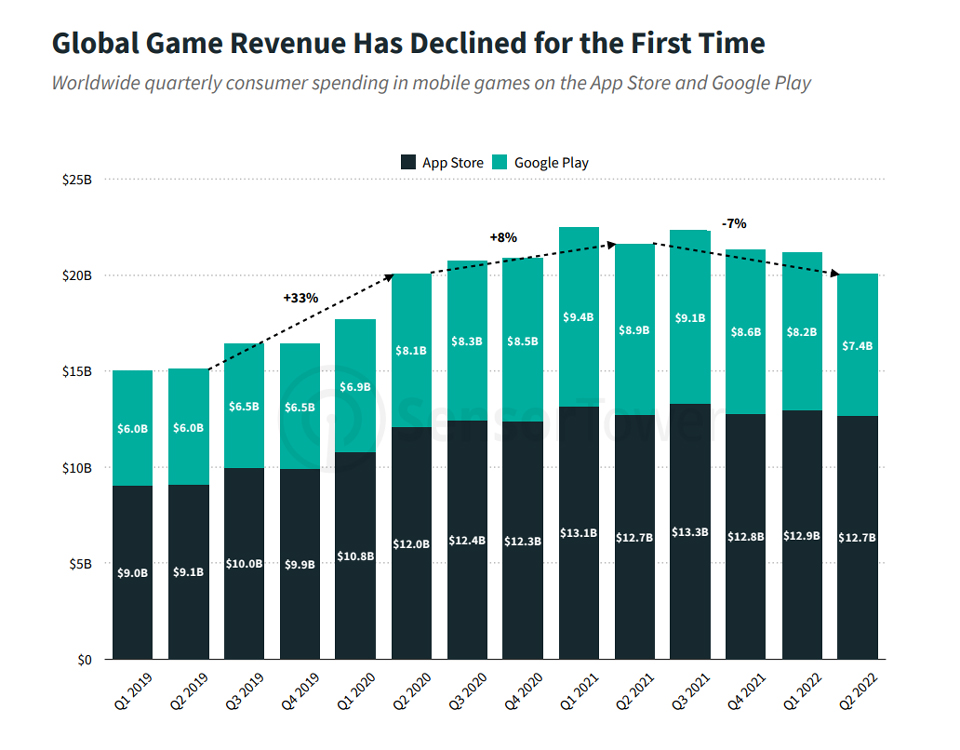

Notwithstanding, mobile game revenue declined Y/Y for the first time in history during Q1 2022. Player spending declined 6% Y/Y to $21.2 billion, primarily due to the high base of comparison from the previous year. Spending was still up nearly 20% compared to Q1 2020.

Notwithstanding, mobile game revenue declined Y/Y for the first time in history during Q1 2022. Player spending declined 6% Y/Y to $21.2 billion, primarily due to the high base of comparison from the previous year. Spending was still up nearly 20% compared to Q1 2020.

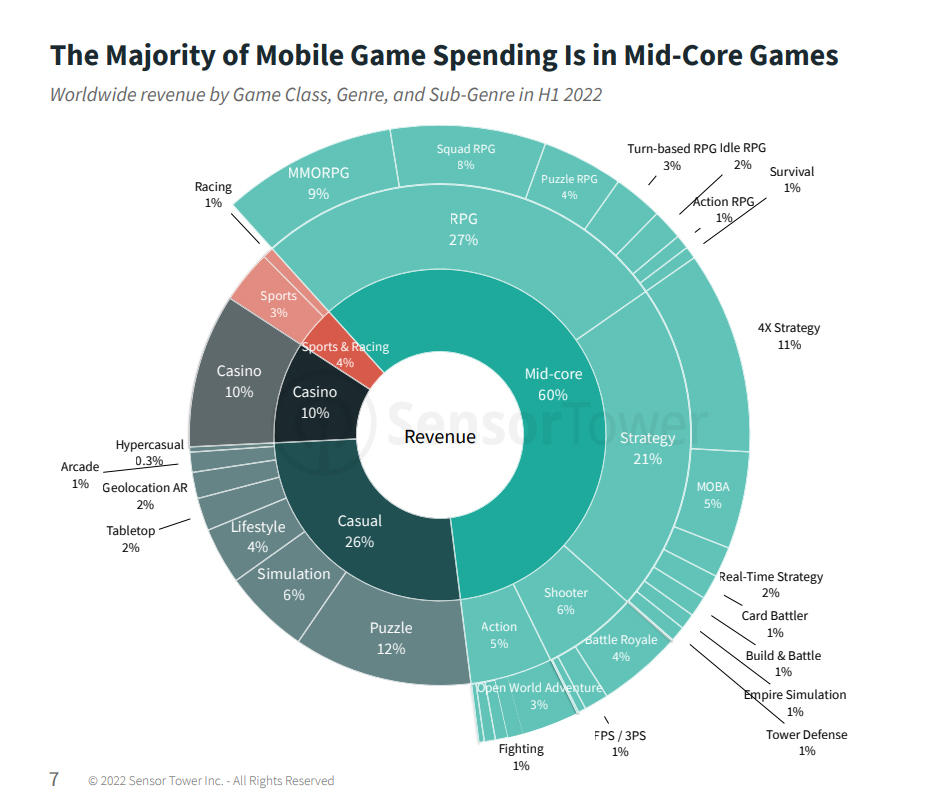

The Mid-Core class includes game genres appealing to a more dedicated gaming audience. It requires a significant time investment by players, has complex mechanics, and monetizes through in-app purchases. Mid-Core accounts for 60% of worldwide player spending.

The Mid-Core class includes game genres appealing to a more dedicated gaming audience. It requires a significant time investment by players, has complex mechanics, and monetizes through in-app purchases. Mid-Core accounts for 60% of worldwide player spending.

The U.S market still remains the first place in the top markets for mobile games. However, the U.S player spending declined 11% year-over-year during Q2 2022 compared with 2021.

The U.S market still remains the first place in the top markets for mobile games. However, the U.S player spending declined 11% year-over-year during Q2 2022 compared with 2021.

Especially, Taiwan, which has displaced Germany as the fifth largest market, is growing. Revenue increased during Q2 2022 to nearly $650 million, and consumer spending in this country reached $1.3 billion in H1 2022.

Mobile Advertising Outlook:

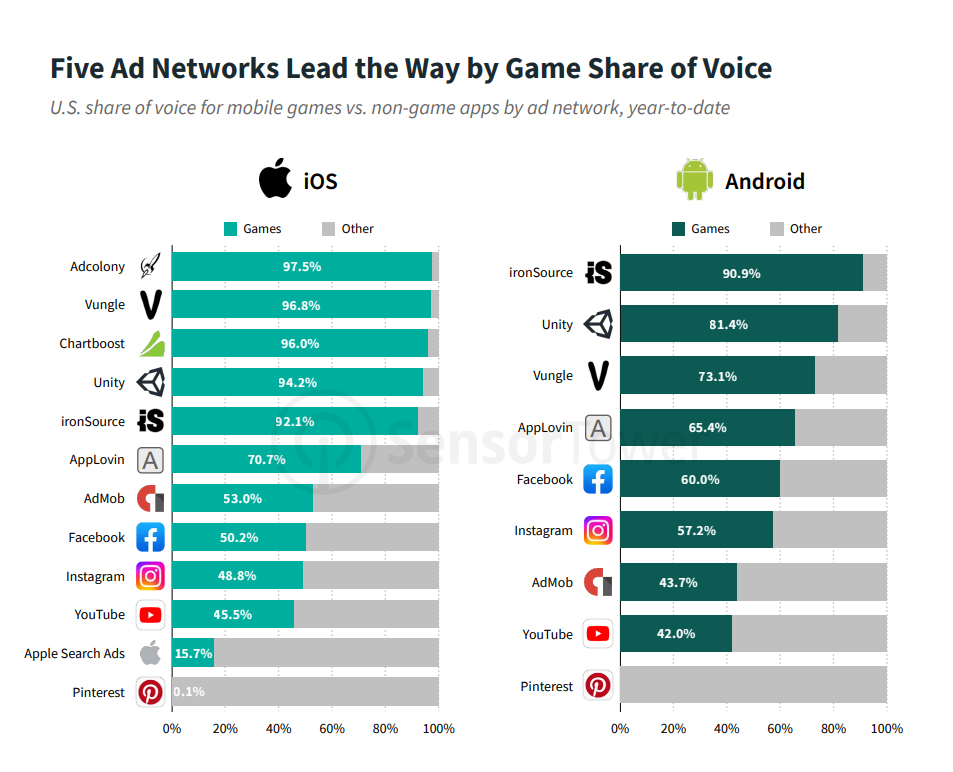

On iOS, five ad networks were primarily focused on mobile games and had at least 90% of their share of voice come from games, including Adcolony, Vungle, Chartboost, Unity, and ironSource.

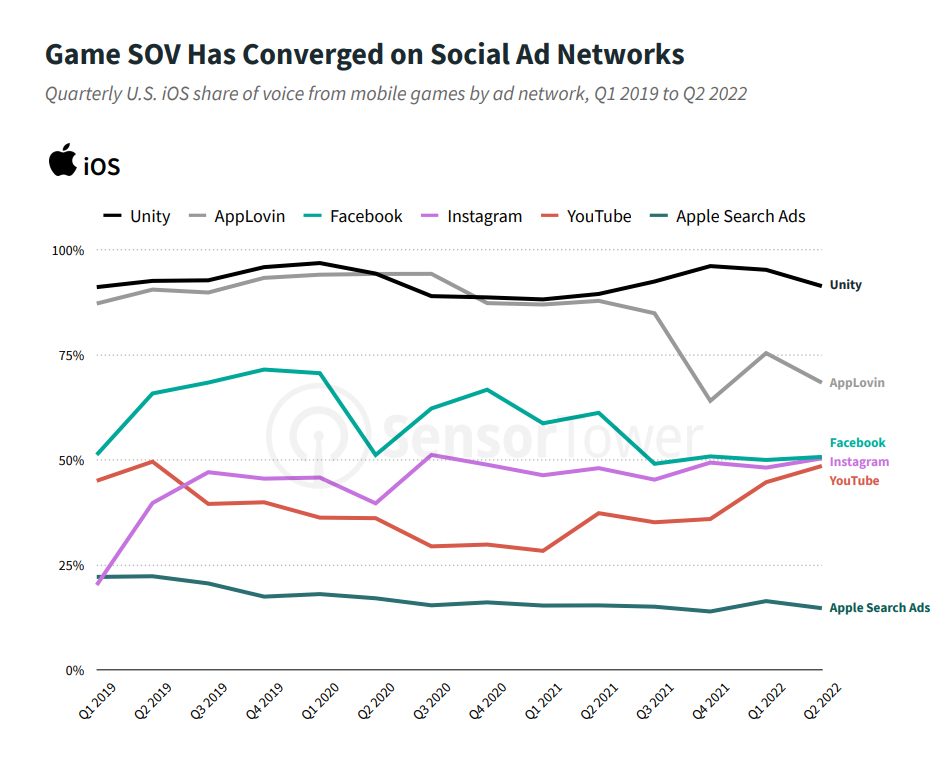

Youtube has seen the share of voice from games gradually decline in recent years before an uptick starting in 2021.

Similar to iOS, AppLovin’s share of voice from Google Play games has decreased in recent quarters. Share of voice from mobile games increased to more than 35% on Youtube in the first two quarters of 2022.

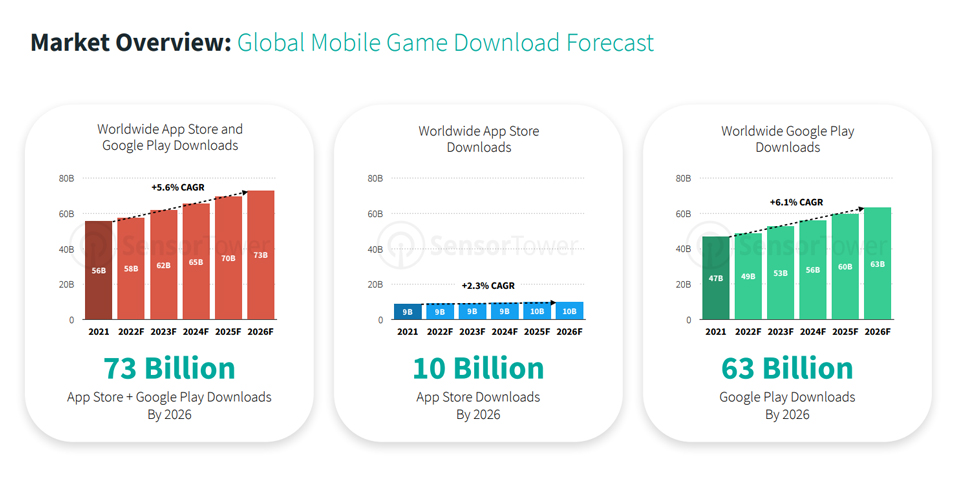

In conclusion, positive revenue growth of the mobile game market is projected to return in 2023, with the total consumer spending reaching $117 billion by 2026.

ABI Game Studio